How to Authenticate or Apostille a Bank Statement?

If you’re planning to move, study, work, or invest abroad, chances are you’ll need to show proof of income or financial stability. In many cases, that proof comes in the form of a bank statement apostille or an authenticated bank document.

While the procedure may seem confusing initially, it’s actually quite simple after you understand the steps and what authorities expect. This blog will walk you through how to prepare, notarize, and submit your bank statement so it’s accepted overseas without delays.

Why You May Need to Authenticate or Apostille a Bank Statement

Different countries and institutions may ask for bank records when you’re handling official matters abroad. Here are some of the main reasons.

Typical Use-Cases for an Apostilled or Authenticated Bank Statement

Foreign governments and institutions often require proof of funds before issuing a visa, approving property purchases, or finalizing long-term contracts. A notarized bank statement is commonly requested during:

- Visa applications (student, work, retirement)

- Immigration proceedings

- Overseas real estate or business investments

- Enrolling in universities abroad

- Showing financial sponsorship for dependents

If you’re traveling to a country that follows strict documentation rules, a certified bank statement with the correct authentication can save time and prevent your application from being rejected.

Key Differences Between Apostille vs. Authentication for Bank Statements

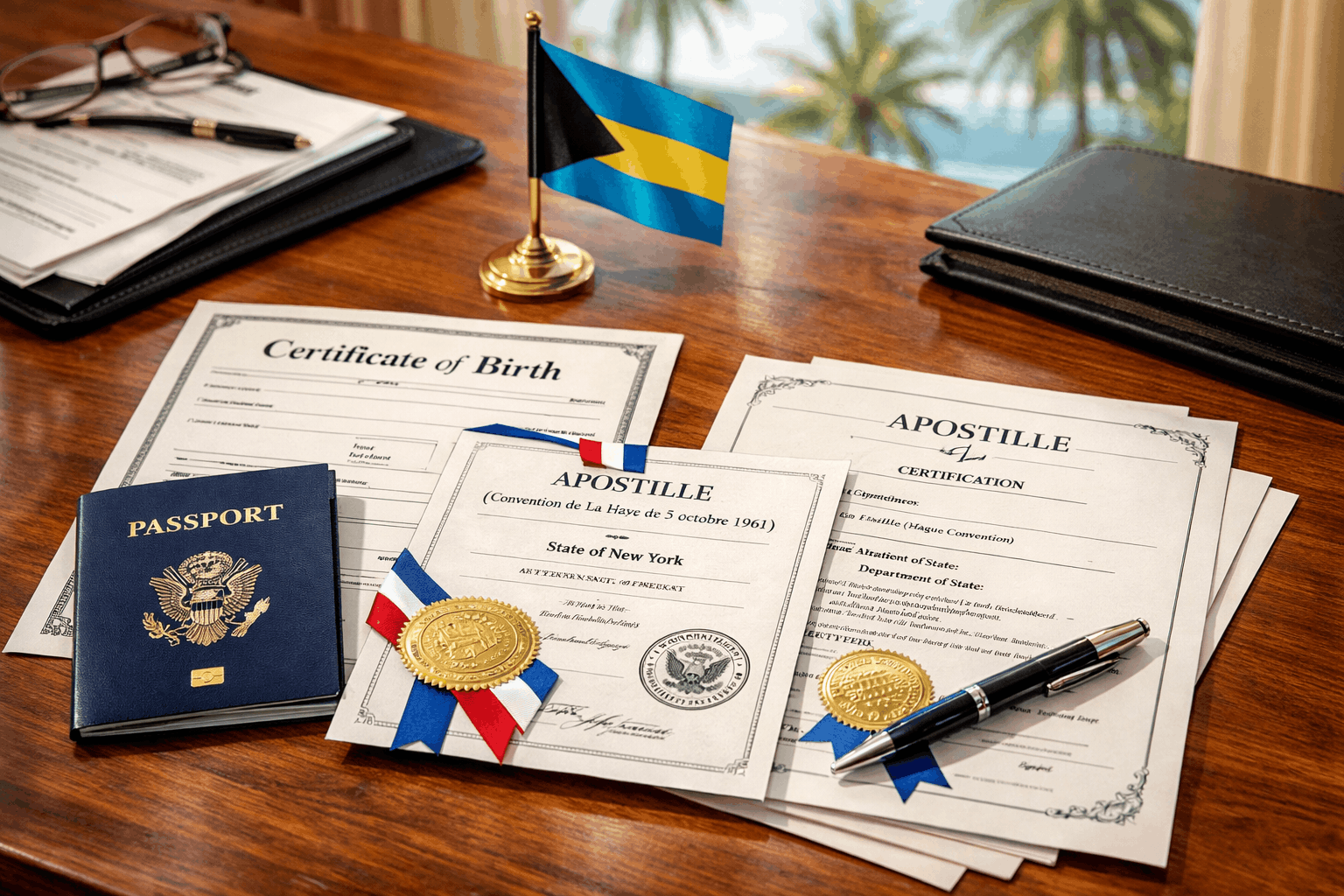

Whether you need an apostille or a consular authentication depends on the country you’re sending your documents to. If the country is a member of the Hague Apostille Convention, your documents will need an apostille, which serves as a simplified form of certification. On the other hand, countries not in the Hague system require authentication and embassy legalization.

An apostille simply verifies the notary’s signature and public seal. Authentication is a more detailed process that requires approval from the U.S. Department of State as well as the embassy of the country where the document will be used. You must know which process applies to your case so that you can avoid the mistake of sending your bank certificate to the wrong authority.

Step-by-Step Process to Prepare Your Bank Statement for Foreign Use

Here’s a breakdown of the process, from requesting the right version of your statement to submitting it for international recognition.

1. Obtain the Correct Version of Your Bank Statement

Start by requesting the most recent version of your bank statement. Most banks allow you to download a PDF through online banking, but you’ll need to print it before notarization. Make sure the statement is complete, unaltered, and issued directly by the bank.

2. Notarize the Bank Statement

A bank statement must be notarized before you can request an apostille or authentication. You can either have a bank representative sign an affidavit and notarize it, or sign your own affidavit stating that the document is a true copy. Many banks offer in-house notary services, which is the simplest option.

When completing this step, ensure your notarized bank statement includes a clear notary seal, the date, and full notarial language. Avoid using a digital notary if the issuing state does not accept remote notarization for apostille purposes.

3. Identify the Destination Country’s Recognition Regime

Find out if the country you’re sending documents to belongs to the Hague Apostille Convention, as this will affect the type of certification you need. If it is, your notarized statement will be processed through a state-level apostille. If not, your document will require multi-step authentication of a bank certificate, including U.S. Department of State and embassy involvement.

You can find an updated list of Hague Convention countries on most Secretary of State or U.S. Department of State websites. You must verify this early to avoid submitting to the wrong authority.

4. Submit the Bank Statement for Apostille or Authentication

When your notarized bank statement — whether from Bank of America or another institution — is ready, you can submit it to the Secretary of State where the notarization took place. Make sure to include any required forms, ID copies, and fees. Moreover, specify the destination country accurately.

For non-Hague countries, you’ll also need to submit the document to the U.S. Department of State and then to the embassy of the destination country. This multi-step route is the authentication and legalization procedure.

5. Receive and Use the Certified Document Abroad

After processing, you’ll receive a certified document either by mail or courier. The apostille or authentication certificate will be attached to the original certified bank statement — don’t separate the two, or it will be considered invalid. Keep a digital backup in case an institution requires an electronic submission.

Special Considerations Depending on Origin and Destination

The exact steps may differ depending on the state that issued your document and the country where it will be used.

If Your Bank Statement Is From a U.S. State vs. a Federal Bank

Documents from commercial banks (e.g., Chase, Wells Fargo, Citibank) require a state-level apostille or authentication. However, if you’re using a document issued by a federal agency or a bank, you may need to process it through the U.S. Department of State.

Always check where the notarization occurred and match that with the correct jurisdiction. You shouldn’t send a state-notarized document to the federal level, as this will result in delays.

For Destination Countries Under the Hague Apostille Convention

If the country you’re sending your document to is a member of the Hague Apostille Convention, you only need to notarize it and then submit it to the appropriate Secretary of State. Your bank statement apostille will then be valid in that country without further steps.

For Destination Countries Outside the Hague System

If your document is heading to a non-Hague country (such as China, UAE, or Egypt), you must follow the full authentication route. This includes:

- Notarization

- Secretary of State authentication

- U.S. Department of State authentication

- Embassy or consulate legalization

Each step must be completed in order. Take extra precautions to ensure that you don’t skip any step of the process, as this may result in rejection.

Bank-Specific or Document-Specific Requirements

Some countries or institutions require a statement issued within 30–90 days. Others may ask for a notarized bank statement from Bank of America, along with extra verification letters.If you’re submitting the document in a non-English-speaking country, get a certified translation. Both the original and translated copies should be submitted together. The translation may also need notarization and its own apostille.

Common Pitfalls and How to Avoid Them

There are some common mistakes that can cause rejections and delays. Make sure to keep an eye out for them.

Not Using Original or Certified Copy Issues

Avoid using printed screenshots or altered PDFs because foreign authorities may reject documents that don’t appear authentic. Also, always request a certified bank statement directly from your bank and ensure the notarization is performed correctly.

Notarization Flaws

Notarization is often rushed or done incorrectly. You need to ensure that this doesn’t happen. Be extra careful of the following flaws:

- Missing or illegible seal

- Notary’s commission expired

- No notarial certificate language

- Notary forgot to sign or date

The above issues will lead to apostille rejection. Make sure to double-check everything before submission.

Choosing the Wrong Route

Some applicants send apostille requests to the U.S. Department of State when their documents should have gone to a state office. Remember, whether you need an apostille or authentication depends on the destination country. Confirm the correct route before submitting anything.

Delays From Missing State or Federal Steps

Each stage must be completed in sequence. Sending a notarized bank statement directly to an embassy without going through the Secretary of State and Department of State (if applicable) will result in a rejected application.

Embassy or Consular Legalization Mistakes

Embassies have their own rules. Some require additional forms, passport copies, or appointments. Always check the consulate’s website and follow their procedures exactly to avoid having your bank statement apostille rejected at the final step.

Timeline, Fees, and Processing Expectations

You must plan ahead so you have enough time and budget to complete the process properly.

Typical Processing Time for Apostille

Most Secretary of State offices complete apostilles in 1 to 3 weeks. In-person submissions are usually faster. Moreover, in some states, you can avail expedited services. However, this will cost you a little extra.

Typical Processing Time for Authentication + Legalization

For non-Hague countries, expect a longer process. State and federal authentication can take 3 to 6 weeks. Besides that, embassy legalization can also add another 1 to 2 weeks, depending on volume. You need to take into account these factors and prepare in advance.

Budgeting for Fees and Additional Costs

Fees vary:

- Secretary of State: $10–$25 per document

- Department of State: $20 per document

- Embassies: Varies by country (often $50–$150)

Also budget for:

- Shipping (domestic and international)

- Notary services (free at some banks, $10–$20 elsewhere)

- Translation if required

- Third-party service provider fees if you outsource the process

Expedited Service Options

If you’re facing tight deadlines — visa interviews, school start dates, contract signing, or last-minute relocation — expedited processing can make a critical difference. Many state offices offer rush apostilles, but availability and turnaround times vary widely, and some states no longer accept walk-ins.

In these situations, professional support becomes especially valuable. EZ Apostille provides expedited submission and document handling, ensuring your notarized bank statement reaches the correct authorities without avoidable delays. Our team monitors processing times across all states, pre-screens documents for common errors, and uses priority handling and courier services to accelerate each step of the process. That means you get a properly certified bank statement faster and can move forward with your plans without unnecessary stress.

Key Takeaways for Apostilling a Bank Statement

With the right preparation, apostilling or authenticating your bank statement becomes a manageable task. By following the proper steps and submitting a notarized bank statement that meets your destination’s rules, you can avoid delays and focus on your move, study program, or investment plans. Double-check whether you need an apostille or full authentication, and don’t overlook important details like translation or notarization format.

FAQ

Can I apostille a bank statement if it’s older than six months?

In most cases, no. Many institutions and consulates require the statement to be recent, usually within 30 to 90 days.

Will apostilling a bank statement expose my financial information to third parties?

No. Apostille agencies and government offices only certify the notary’s signature. They do not review or retain your account details.

Can I use a bank statement from an online-only or app-based bank for an apostille?

Yes, as long as the statement is properly notarized. You may need to print it, sign an affidavit, and visit a local notary before submitting it for apostille.

Can a bank statement with sensitive transactions be partially redacted before an apostille?

Redactions are not recommended. Most authorities require complete documents. If privacy is a concern, check with the recipient to see if a summary or balance statement is acceptable.

Can I use the same apostilled bank statement for multiple applications in different countries?

Yes, provided the document is still recent and the countries are Hague members. For non-Hague countries, new authentication or embassy legalization may be required for each country.