Bank Letter Apostille: What It Is and How to Get It

Everything is gaining momentum with your partnership overseas, until you’re asked to submit a bank letter apostille. Although the document itself works fine at home, you need to authenticate it for use in another country. So, what is a bank letter, and how can you obtain an apostille to validate your financial standing? Today’s post will clarify this precise process, helping you achieve instant recognition when presenting your bank letter outside the U.S.

What is a Bank Letter for International Use

A bank letter, also known as a bank verification letter, is an official document that your financial institution issues to specify your banking relationship. It confirms your account type, transaction history, and balance. Foreign authorities often require this to verify your income or financial credibility.

Common Situations When a Bank Letter Is Required Abroad

Typically, you’ll need the document when formally proving your financial health to officials and institutions abroad. Some scenarios include:

- Visa or residency application: Immigration offices demand sufficient deposits to ensure applicants can support themselves during their stay.

- Real estate purchase or rental abroad: Landlords or realtors sometimes request evidence of funding before finalizing agreements.

- Financial support for foreign school enrollment: Academic institutions often ask potential students to submit proof of support for their studies.

Essentially, various major legal and administrative procedures across international borders that involve money will likely require your financial documentation.

Types of Bank Letters That May Need an Apostille

The general bank verification letter verifies ownership and account status. In addition, you may also be requested to submit these certified documents with specific account details:

- Credit reference: Outline credit history with previous lenders.

- Proof of funds: Show current account balance.

- Direct deposit letter: Set up direct deposits for recurring payments.

Each of them must be properly signed and sealed by a designated bank official who has the capacity to verify the account details required for apostille certification.

When and Why a Bank Letter Needs an Apostille

A standard bank letter for domestic use isn’t automatically effective in a foreign jurisdiction. Authorities abroad request an apostille — a form of international authentication that confirms the legitimacy of the letter and the signature on it.

Acceptance Requirements of Foreign Authorities

Government agencies and international banks, particularly those that are member countries of the Hague Convention, explicitly ask for the apostille during official processes. Without this special certificate, your bank verification letter would be considered unverifiable, resulting in outright refusal of your application.

Difference Between Apostille and Other Forms of Verification

The apostille is a process created under the Hague Convention to streamline document verification for use abroad. While a notary’s seal is only acceptable within the U.S., the apostille extends that validation beyond borders. For nations outside the Convention, you must follow the more complex method of legalization.

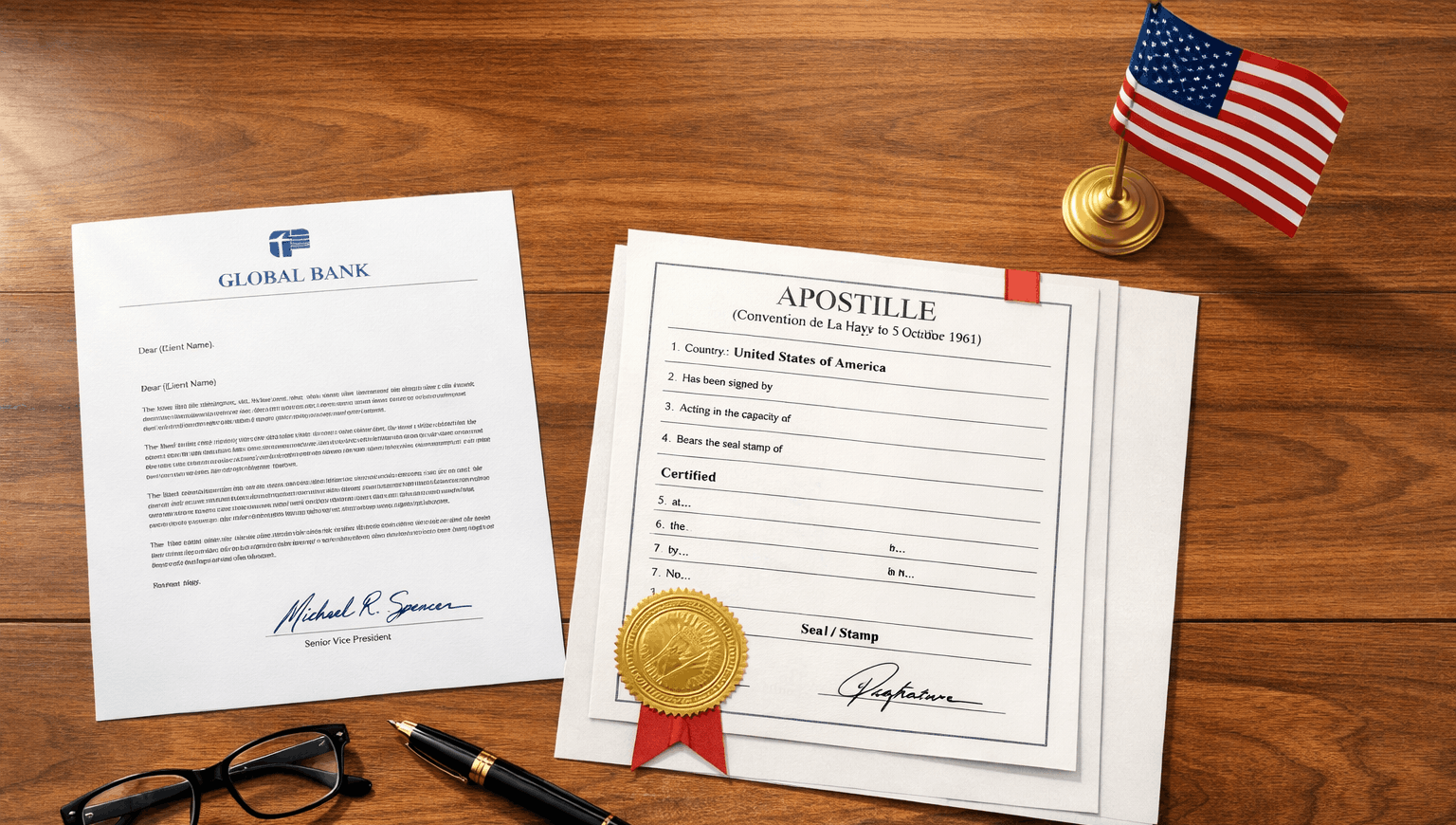

Who Issues and Signs a Bank Letter for Apostille Purposes

The financial institution where the respective account is held is responsible for preparing and issuing bank letters. Specifically, an authorized bank officer signs them in the presence of a state-commissioned notary public. The apostille ultimately verifies the notary’s capacity to complete the authentication chain needed for international acceptance.

Common Mistakes That Can Delay Apostille Processing

Many think that sending their bank letter to the state office for an apostille is straightforward, but certain errors can lead to a dead end. The most frequent pitfall is providing an improperly notarized letter, as the bank’s seal alone is insufficient for processing. Another oversight is submitting a request to the wrong authority — the apostille comes from the state where the notary is licensed, rather than the state where the bank is headquartered.

Step-by-Step Process to Apostille a Bank Letter

Don’t know where to start? Following the five sequential steps below will make things more manageable when requesting an apostille for the bank letter from your Secretary of State’s office. To eliminate lapses and guarantee smooth acceptance overseas, keep this order:

Step 1 – Confirm the Bank Letter Format and Purpose

Begin by verifying why the bank verification letter is needed and how it should be presented. Contact the requesting authority for specific requirements — do they need balance confirmation, proof of direct deposits, or credit reference? A document providing the wrong information is useless even if it’s perfectly apostilled, so make sure you get the exact content and formatting for your letter.

Step 2 – Obtain Required Notarization

Once you have the final draft of the letter, it must be signed by an authorized bank officer in front of a notary public. Since this document is considered private and not government-issued, notarization is mandatory to verify the signer’s capacity and prove that the paperwork is real to the apostille office.

Step 3 – Identify the Correct Apostille Authority

Bank letter apostilles are issued by the Secretary of State’s office or an equivalent government agency in the state where the notarization took place. Misdirected submission is among the most common mistakes, so always confirm the correct office before proceeding.

Step 4 – Submit the Bank Letter for Apostille Processing

Gather the notarized letter, complete any required forms or cover sheets, and pay the apostille fee. You can choose between mail-in submission for standard processing and in-person drop-off for faster service. Don’t forget to include a prepaid return envelope if you would like the apostille to be mailed back to you.

Step 5 – Receive and Verify the Apostilled Document

After processing, you’ll receive the bank letter with the apostille certificate affixed. Inspect it carefully to ensure everything is accurate and aligns with the destination country’s requirements. You may want to make copies for your records before forwarding the original apostilled letter abroad.

Processing Details and Time Considerations

Apostilling a bank letter may take around 1 to 3 weeks when you choose the standard option in most states, depending on the workload of the authentication unit. Processing fee ranges from $5 to $25 per letter. Expedited and rush options are available and can reduce the wait to a few business days for an additional fee. It’s recommended to factor in the time it takes to get the letter notarized and mailing transit as well.

Apostille Requirements Based on Place of Issuance

The process outlined in this post applies to letters issued by U.S. banks. In contrast, those issued by foreign banks for use in the U.S. can’t be authenticated by either state or federal authority. They must go through the apostille or legalization procedures in their country of origin before they can be accepted.

Using a Professional Apostille Service for Bank Letters

Working with a reliable expert service like EZ Apostille removes the pressure of preparing your bank letters for acceptance worldwide. Here’s how we make things easier for your global journey:

- Handle the complexities: No more guesswork about government forms or agencies — we manage the entire workflow from preparation to submission.

- Convenient national coverage: Regardless of which state your bank is located in, our team processes your letter fast and correctly.

- Real-time progress updates: You gain absolute clarity and control with our transparent tracking system, so you’ll stay informed at every moment.

Relying on our professionals helps you avoid costly errors when requesting an apostille for your bank letter and saves the most valuable resource you have — time.

Final Considerations

While the roadmap to obtaining authentication for bank letters is clear, it requires understanding the purpose, following state-specific protocols, and managing timelines efficiently to succeed. For many, partnering with EZ Apostille is key to complete assurance. With our expertise, your apostilled bank letter will become a trusted instrument for global applications and transactions in any setting.

FAQ

We’ve encountered many questions about bank letter apostilles, and here are the most frequent ones along with clear answers:

Can a digital or emailed bank letter be authenticated with an apostille?

No, most apostille offices expect the original, signed document to attach a physical apostille certificate. Some states participate in the electronic Apostille Program (e-APP) and may accept digital bank letters, provided they are electronically signed and notarized by a remote online notary (RON). However, check with the state authority directly to ensure your letter meets their standards.

Does the bank need to be physically located in the same state as the apostille request?

Not necessarily, as notarization is a more critical factor, and the apostille office authenticates the notary’s signature, not the bank official directly. Thus, while the bank letter may originate from a different state, the notarized signature must happen in the same state where you apply for the apostille.

Can a bank letter be apostilled if it was issued several months ago?

It depends on whether foreign authorities prefer recent letters or not. Sending an outdated document when the requesting institution demands current financial information will result in rejection. Check the recency requirements before you start.

Is an apostille required for bank letters used only for short-term purposes abroad?

Not really, as the requirement hinges on the official request of foreign governments, not the duration of your stay. If your application specifies an apostilled bank letter, you must provide it even for a short-term visa or permanent residency.

Can one apostille be used for multiple countries?

Technically, no. Since the apostille states the place of its intended use, you risk rejection if sending one to a country different from what is disclosed on the certificate. However, you can request two or more apostilles at the same time for the same bank verification letter that will be used in multiple countries.