Apostille for IRS Form 6166 (U.S. Tax Residency Certificate): Full Guide

If you’re doing business, receiving income, or claiming treaty benefits in another country, there’s a good chance you’ve heard of IRS Form 6166 – the U.S. Tax Residency Certificate. But what happens when a foreign government requires proof that this document is authentic? That’s where an apostille for Form 6166 comes in.

In this guide, the experts at EZ Apostille break down everything you need to know in 2025 to apostille this important IRS document – step by step, without confusion. Whether you’re a business owner, investor, or working abroad, this article will help you get your paperwork recognized internationally.

What Is IRS Form 6166 and Why Is It Important?

IRS Form 6166 is a certification of U.S. tax residency, issued by the Internal Revenue Service (IRS). It’s used primarily to claim income tax treaty benefits with countries that have a treaty agreement with the United States. These benefits often include reduced withholding rates on dividends, interest, royalties, and other income sourced abroad.

Foreign tax authorities require this certificate to verify that the entity or individual is indeed a resident for tax purposes in the United States. Without it, you could be subject to double taxation or be denied treaty relief entirely.

For more details on how the IRS issues this form, see the official IRS instructions here: IRS Publication 686.

Why You Might Need an Apostille for IRS Form 6166

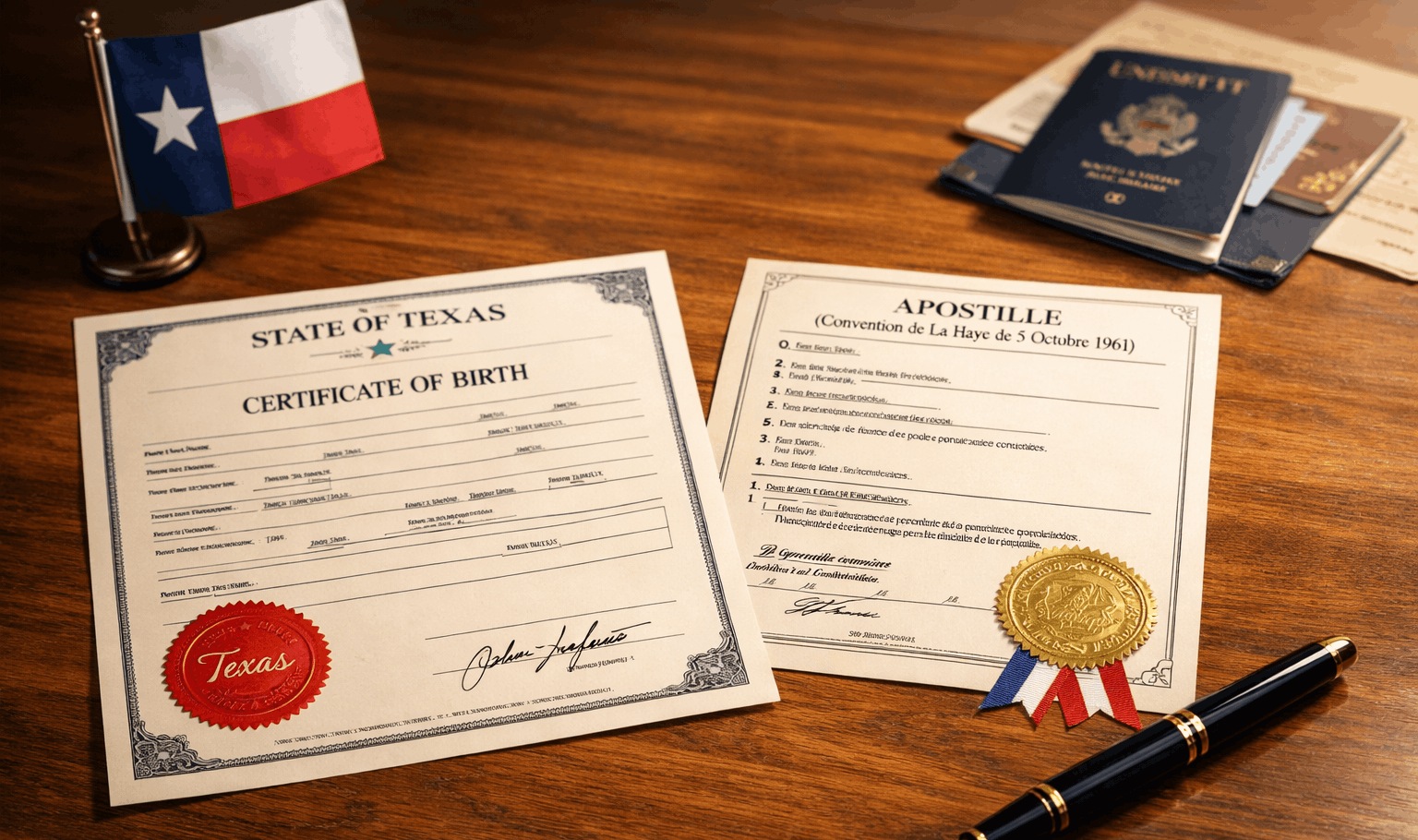

IRS Form 6166 is a federal document, and while it is valid in the U.S., many foreign governments require an apostille to legally accept it under the Hague Apostille Convention. If you’re submitting this form to a government, financial institution, or corporate registrar abroad, an apostille will confirm the document’s authenticity.

You may need to apostille IRS Form 6166 for the following reasons:

- To reduce withholding tax on foreign-sourced income

- For cross-border business registration or compliance

- To validate U.S. tax residency for dual-taxation treaty relief

- When managing international investments or pensions

- For foreign tax audits or compliance verification

How to Apostille IRS Form 6166: Step-by-Step

H3: Step 1 – Request IRS Form 6166 from the IRS

Before you can apostille the document, you’ll need to obtain it from the IRS by submitting Form 8802 (“Application for United States Residency Certification”). This application must be filed in advance and usually takes 4 to 6 weeks to process.

To apply:

- Download and complete Form 8802

- Pay the applicable user fee ($85 for most individuals or businesses)

- Submit the form to the IRS address provided in the instructions

Once approved, the IRS will issue your Form 6166 on official letterhead with a signature from a U.S. Treasury official. Keep this document in pristine condition, as alterations may void its validity for apostille purposes.

H3: Step 2 – Submit Form 6166 for Federal Apostille

Unlike many apostilles that are issued by state governments, IRS Form 6166 must be apostilled at the federal level through the U.S. Department of State in Washington, D.C. This is because it is a federal document signed by an official of the Department of Treasury.

To apostille the form:

- You must submit the original Form 6166

- Include a completed DS-4194 form (authentication request)

- Pay the applicable apostille processing fee

- Include a prepaid return envelope

You can find the full instructions on the U.S. Department of State Apostille Services page.

Working with an experienced apostille services provider like EZ Apostille ensures the submission is correct and compliant – saving you time and avoiding rejections.

Common Mistakes When Apostilling Form 6166

Many professionals attempt this process on their own and encounter problems. These common errors can delay processing or lead to complete rejection.

Top errors to avoid:

- Sending a copy instead of the original IRS-issued Form 6166

- Mailing to a state authority instead of the U.S. Department of State

- Submitting an incomplete or outdated DS-4194 form

- Not including proper payment or return envelope

- Altering or stapling the document (can void its eligibility)

“Apostilling a federal tax document like Form 6166 is not the same as apostilling a birth certificate or diploma. It requires a specific process that many people aren’t aware of.”

— EZ Apostille Document Expert Team

To avoid these mistakes, always begin by requesting multiple original copies of IRS Form 6166 when filing Form 8802 – this ensures you have a clean copy available for apostille. Make sure you are sending your documents to the correct federal authority: the U.S. Department of State in Washington, D.C., not a state-level office. Use the most up-to-date version of Form DS-4194, fill it out completely, and clearly specify the destination country.

Double-check that you’ve included all required fees and a trackable, prepaid return envelope – many delays happen because of missing or incorrect mailing materials. Lastly, never staple, fold, or write on the document. Place it in a protective folder to keep it pristine. If you’re unsure at any step, relying on a trusted apostille service like EZ Apostille can help ensure your documents are accepted the first time.

Checklist: What You Need to Apostille IRS Form 6166

Before sending your request, make sure you have all the required elements. Missing one piece can delay the process by several weeks.

Essential Items:

- Original IRS Form 6166 (no copies)

- Completed Form DS-4194

- Payment (check or credit card authorization form)

- Prepaid return envelope

- Cover letter (if required by courier or legal team)

At EZ Apostille, we offer document pre-checks to ensure nothing is missing before submission.

Why Use EZ Apostille for IRS Form 6166?

When dealing with IRS and federal documents, accuracy, speed, and experience are essential. IRS Form 6166 is not processed at the state level – it requires direct coordination with the U.S. Department of State, which follows strict submission standards. A single mistake can delay your apostille for weeks or result in rejection.

At EZ Apostille, we specialize in federal-level apostille services, including tax and Treasury documents like IRS Form 6166. Here’s why clients across the U.S. and internationally trust us:

- Direct processing with the U.S. Department of State. We handle all the paperwork and ensure it reaches the right federal office.

- Fast-track options. Expedited services available to meet tight business or regulatory deadlines.

- Secure document handling. We use trusted courier services and monitor every stage of the process.

- Pre-submission review. Our specialists check all forms and documents for completeness, accuracy, and compliance.

- Expert knowledge. We understand IRS workflows, apostille regulations, and the unique needs of businesses and individuals operating internationally.

Whether you’re claiming a tax treaty benefit or submitting documentation to a foreign tax authority, our team helps eliminate errors, reduce turnaround time, and give you peace of mind.

With EZ Apostille, you won’t waste time on trial and error – we’ll guide you through every step and handle the logistics from start to finish.

Final Thoughts: Get It Right the First Time

Apostilling IRS Form 6166 isn’t something you do every day – but when you need it, it must be done right. With strict federal requirements and international deadlines to meet, getting expert help can make all the difference.If you’re ready to move forward or want your documents reviewed, contact the EZ Apostille team today. We’re here to help you get your apostille quickly, correctly, and with peace of mind.